- The Capitalist

- Posts

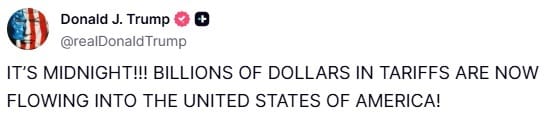

- Trump celebrates reciprocal tariffs going live with midnight post

Trump celebrates reciprocal tariffs going live with midnight post

"Billions of dollars are now flowing into the United States Of America"

Hello Capitalists,

Here’s what you need to be paying attention to today:

Trump pulls the trigger on reciprocal tariffs with celebratory post

401K’s are about to have a lot more investment options

Crypto surges on the 401K news

Intel just got called out for its questionable partners

Today’s markets:

DOW: 4392.37 - (⬇️0.61) 🔴

S&P: 6340.89- (⬇️0.07) 🔴

NASDAQ: 21246.27 - (⬆️0.99) ✅

CBOE VIX Volatility Index: $17.01 (⬆️0.24) ⚠️⬆️

Trump’s midnight tweet heralds tariffs going live - “Billions of dollars”

President Donald Trump's "reciprocal" tariffs took effect Thursday, imposing higher duties on exports from dozens of U.S. trading partners.

Tariff Implementation: President Donald Trump's "reciprocal" tariffs went into effect at midnight on August 7, 2025, raising duties on exports from numerous U.S. trading partners, with rates as high as 41% for Syria, 40% for Laos and Myanmar, and 39% for Switzerland.

Specific Country Impacts: Brazil and India face 50% tariffs, with India's rate starting at 25% and increasing later in August due to its Russian oil purchases, while countries like the EU, Japan, and South Korea secured lower 15% tariffs through trade agreements.

Trade Strategy and Revenue: Trump described the tariffs as targeting countries that have "taken advantage" of the U.S., with Commerce Secretary Howard Lutnick estimating $50 billion monthly in tariff revenue, though the economic impact on growth and inflation remains uncertain.

Global Reactions and Negotiations: Some nations like the UK negotiated lower 10% tariffs, while China and Mexico remain in trade limbo, with analysts warning that the tariffs could disrupt global markets and supply chains.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Quote of the Day:

“In the end, you're measured not by how much you undertake but by what you finally accomplish.”

Trump to sign executive order to allow 401K’s to diversify investment including into crypto

President Donald Trump will sign an executive order Thursday to allow 401(k) retirement plans to include alternative assets like cryptocurrencies, private equity, and real estate, a move aimed at diversifying investment options for millions of Americans.

Market Impact: The order could open the $8.7 trillion 401(k) market to alternative asset industries, with BlackRock planning a 401(k) target date fund with 5% to 20% private investments by 2026.

Industry Support: The alternative asset industry, which has lobbied for greater access to retirement plans, views this as a significant victory during Trump’s second term.

Regulatory Review: The order instructs the Labor Department to reassess ERISA guidelines to facilitate the inclusion of these assets, potentially reshaping retirement investment options.

Crypto Market Surges: The crypto market's enthusiasm reflects optimism about broader adoption, building on earlier reports of Trump’s pro-crypto policies, including a national strategic Bitcoin reserve.

The move follows a series of crypto-friendly actions by the Trump administration, though some market caution persists pending further details on implementation.

Ripple adds another acquisition in its march to stablecoin expansion

Ripple, a leading cryptocurrency company and creator of the XRP Ledger, announced Thursday it will acquire stablecoin payments platform Rail.

Ripple will purchase Rail, the Toronto-based stablecoin payments platform, for $200 million, with the acquisition expected to close in Q4 2025 pending regulatory approval.

The deal enhances Ripple’s stablecoin offerings, particularly its RLUSD stablecoin, by integrating Rail’s virtual accounts and automated back-office processes to create a comprehensive payments solution.

Rail, backed by Galaxy Ventures and Accomplice, handles 10% of global stablecoin-based payment activity, offering faster and cheaper cross-border transactions compared to traditional fiat systems.

The acquisition follows a U.S. law signed in July 2025 by President Trump, creating a federal regulatory framework for stablecoins, which is expected to drive mainstream adoption of digital assets.

Intel’s stock takes a beating after Trump raises national security concerns

Intel shares fell nearly 5% in premarket trading Thursday after President Donald Trump demanded the immediate resignation of CEO Lip-Bu Tan.

Article Summary in 4 Bullet Points:

Trump's Demand: President Donald Trump called for Intel CEO Lip-Bu Tan to resign immediately, labeling him "highly CONFLICTED" due to his investments in Chinese firms, some linked to the country's military, as reported by Reuters in April.

Stock Impact: Intel shares dropped approximately 5% in premarket trading following Trump's Truth Social post, which intensified scrutiny on Tan's leadership amid the company's turnaround efforts.

Senator Cotton's Concerns: Sen. Tom Cotton, R-Ark., questioned Tan's ties to Chinese companies and referenced a past criminal case involving Cadence Design, where Tan was CEO until 2021, in a letter to Intel's board chair.

Intel's Challenges: Tan, appointed CEO in March 2025 to revive Intel after declining sales, announced significant cost-cutting measures, including slashing the foundry division and canceling factory projects in Germany and Poland.

Duolingo soars after huge Q2 earnings win driven by AI implementation

Duolingo's stock soared more than 30% in premarket trading Wednesday after the language-learning app reported a robust second quarter.

Strong Financial Performance: Duolingo reported Q2 revenue of $252 million, a 41% year-over-year increase, surpassing Wall Street's $241 million estimate, with net income rising 84% to $45 million, or 91 cents per share.

Raised Guidance: The company raised its full-year revenue forecast to $1.01 billion to $1.02 billion, up from $987 million to $996 million, and increased bookings guidance to $1.15 billion to $1.16 billion, driven by AI-fueled user growth.

AI and Expansion Initiatives: Duolingo expanded its offerings with AI tools like a video-call conversation feature for premium subscribers and acquired music gaming startup NextBeat, while introducing non-language courses like chess.

Optimistic Outlook: CEO Luis von Ahn emphasized exceeding expectations for bookings and revenue while expanding profitability, with a third-quarter revenue projection of $257 million to $261 million, beating Wall Street's $253 million forecast.