- The Capitalist

- Posts

- Trump's 'Big Beautiful Bill' passes through senate, JD Vance breaks the tie

Trump's 'Big Beautiful Bill' passes through senate, JD Vance breaks the tie

After a long hard-fought battle in the Senate the legislation passed, now facing the House for final approval of the Senate's changes...

Hello Capitalist,

Markets have scaled back a bit this morning just before news of Trump’s Big Beautiful Bill passing through the Senate.

DOW: 44517.94 - (⬆️0.96) ✅

S&P: 6198.41 - (⬇️0.11) 🔴

NASDAQ: 20227.67 - (⬇️0.70) 🔴

CBOE VIX Volatility Index: 16.87 (⬆️0.14) ⚠️⬆️

Here is everything you need to know today:

The Big Beautiful Bill passes through the Senate, JD Vance breaks tie

The Senate passed President Trump's Big Beautiful Bill 51-50 after days of negotiations and a record-breaking 24-hour "vote-a-rama" with nearly 50 amendments, with Vice President JD Vance casting the tie-breaking vote. Three Republicans—Senators Thom Tillis, Rand Paul, and Susan Collins—broke with their party to vote against the bill.

House Faces Uncertain Future: The bill now returns to the House where it faces significant challenges, as House Republicans must accept substantial Senate changes including deeper Medicaid cuts, despite some GOP lawmakers already expressing reluctance about the bill's projected $3 trillion addition to the federal deficit over the next decade. Speaker Mike Johnson can only afford to lose three votes in his narrow majority.

July 4 Deadline Pressure: Republican leadership is rushing to get the package to Trump's desk before their self-imposed July 4 deadline, though the bill's passage remains uncertain given continued GOP holdouts in the House who previously voted reluctantly and now face an even more politically difficult version with the Senate's modifications.

Together with Pacaso

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind. That’s why investors like SoftBank are so excited about Pacaso.

Created by the team that grew Zillow to a $16B valuation, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And_ _their target market is worth a whopping $1.3T. No wonder Pacaso has earned over $100M in gross profits. Now, they’re taking their biggest step yet – with a focus on international markets.

Their first two Paris properties sold out in record time, so they just added another. They already have seven homes in Cabo, and they just bought their most expensive European property yet in London. And this expansion is truly just beginning.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

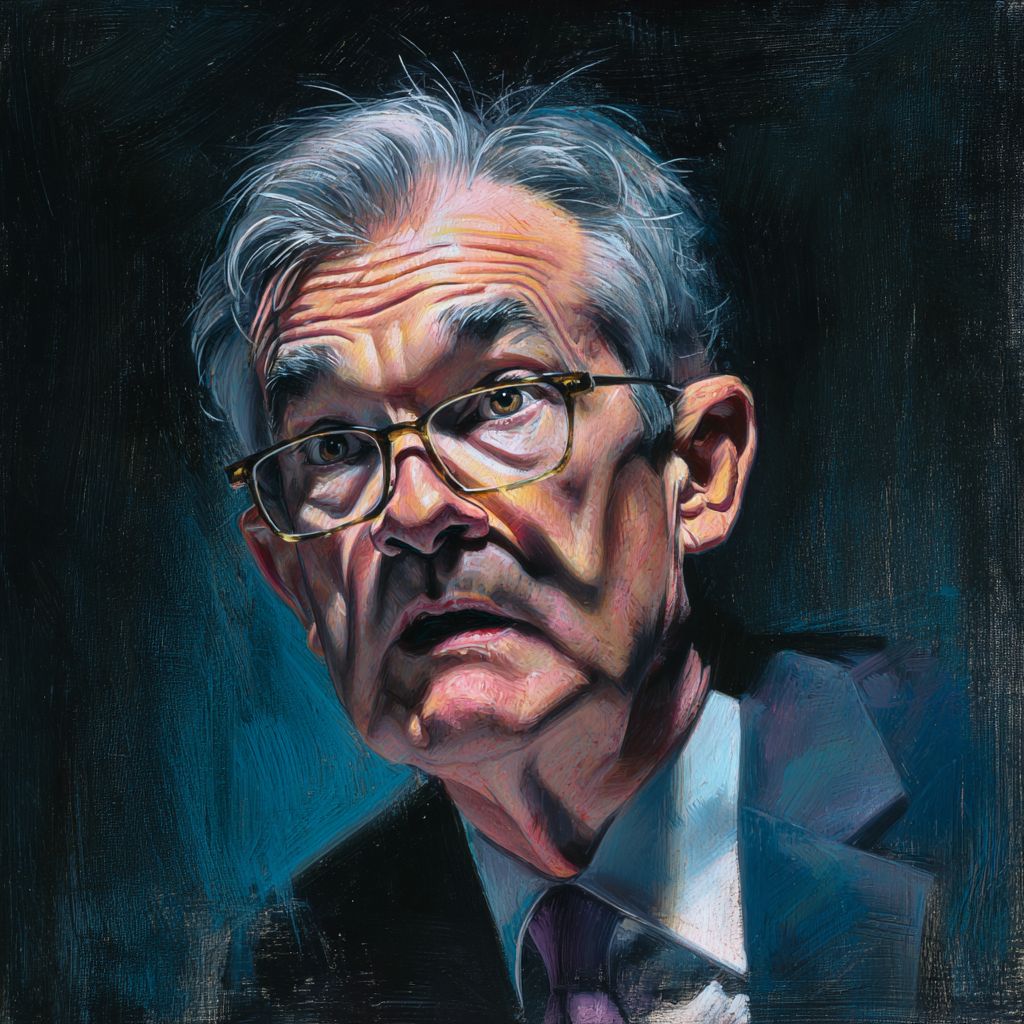

Busted: Jerome Powell accused of lying to Congress…

Federal Reserve Chair Jerome Powell faces accusations of lying to Congress about a $2.5 billion headquarters renovation, with lawmakers and critics slamming him for denying lavish upgrades despite planning documents confirming their inclusion.

Powell denied there would be VIP dining rooms, special elevators, marble, water features, or roof terraces, during Senate Banking Committee testimony, but official planning documents from 2021 explicitly mention "private dining rooms," "Governors' private elevator," "vegetated roof terraces," and new marble and water features.

Lawmakers and economists are demanding punishment for Powell's contradictory statements - Sen. Cynthia Lummis called Powell's testimony "factually inaccurate" and said he "should be embarrassed," while former Fed economist Andrew T. Levin urged Congress to censure Powell, saying "a top Fed official cannot be permitted to make false statements under oath at a congressional hearing."

The renovation costs have ballooned 30% from the original $1.9 billion estimate - Sen. Tim Scott, chair of the Senate Banking Committee, compared the "luxury upgrades" to the "Palace of Versailles," while former DOGE chief Elon Musk called it "an eyebrow raiser" and said the department should "definitely" investigate the spending on what he termed a "glorified vanity project."

The controversy comes as the Fed faces historic financial losses - The central bank has posted $233 billion in losses over the past three years, including a record $114.6 billion loss in 2023, marking the first time in its history it operated in the red, while Powell dismissed cost overrun concerns by saying "the cost overruns are what they are."

Powell says he would have cut rates by now if not for Trump’s tariffs

Federal Reserve Chair Jerome Powell said Tuesday that the central bank would have lowered interest rates by now if not for President Donald Trump's tariff plan, acknowledging that inflation forecasts rose "materially" after the trade policy announcements put the Fed's rate cuts on hold.

The Fed remains in a holding pattern despite White House pressure to cut rates - The central bank has kept the federal funds rate steady at 4.25%-4.5% since December, with Powell saying they're going "meeting by meeting" and wouldn't rule out any specific timing for potential cuts, though futures traders see a 76% likelihood of no change at the July meeting.

Trump has publicly attacked Powell for not lowering borrowing costs - The president called Powell "terrible" and "a very average mentally person" last week, reflecting the administration's frustration with the Fed's cautious approach to monetary policy amid the tariff-induced inflation concerns.

Powell remained noncommittal about his future beyond his 2026 term as Fed chair - When asked if he would stay on as a Fed governor after his chairmanship ends next year, Powell said "I have nothing for you on that today," while emphasizing his goal is to "hand over to my successor an economy in good shape" with price stability and maximum employment.

Quote of the Day:

“As long as your going to be thinking anyway, think big.”

Big Beautiful Bill picks up major new supporter as it fights through congress

President Donald Trump's "One Big Beautiful Bill Act," has a new supporter, the American Bankers Association. This comes as the bill makes its way through congress.

Notable Support: The American Bankers Association strongly supports President Donald Trump's "One Big Beautiful Bill Act," citing its tax relief provisions, which extend the 2017 Tax Cuts and Jobs Act to prevent a fiscal contraction in 2026 by maintaining lower income tax rates, enhanced child tax credits, and business deductions.

Banker’s predictions: Economists and banks, including Nomura and Citi, predict the bill will boost the U.S. economy in the short term by averting tax increases and encouraging business investment, though some warn it may reduce future investment.

Critics and concerns: Critics, including the Congressional Budget Office, warn the bill could add at least $3 trillion to the federal deficit over the next decade, raising concerns about fiscal sustainability despite potential short-term economic benefits.

Companies investing Bitcoin becomes the latest trend with a 20% surge

Public companies surpassed exchange-traded funds in bitcoin purchases for the third straight quarter in Q2 2025, inspired by MicroStrategy’s treasury strategy and a supportive regulatory environment under the Trump administration.

Public Companies Outpace ETFs in Bitcoin Purchases: For the third consecutive quarter, public companies acquired more bitcoin than ETFs, purchasing approximately 131,000 coins in Q2 2025, growing their bitcoin balance by 18%, compared to an 8% increase (111,000 BTC) for ETFs, according to Bitcoin Treasuries.

MicroStrategy Playbook and Regulatory Support Drive Trend: Companies like GameStop, KindlyMD (via merger with Nakamoto), and ProCap are following MicroStrategy’s strategy of holding bitcoin as a treasury reserve asset, encouraged by a crypto-friendly regulatory environment under the Trump administration, highlighted by a March 2025 executive order for a U.S. bitcoin reserve.

Different Motivations for Accumulation: Public companies are focused on accumulating bitcoin to boost shareholder value, unlike ETF investors seeking exposure, with companies leveraging capital markets to acquire more coins, though experts predict this treasury strategy may wane as bitcoin becomes more normalized in the future.

Socialist Mamdani ‘s latest “equitable” idea is city run grocery stores but its already running in to issues

Zohran Mamdani, the democratic socialist New York City mayoral candidate, is pushing a $60 million plan to open city-owned grocery stores in each borough to combat rising food prices, but critics, including economists and Gristedes CEO John Catsimatidis, warn the proposal could disrupt the city’s food supply by outcompeting private grocers and lack of supply chain infrastructure, potentially leading to shortages and store closures.

Zohran Mamdani’s Proposal: New York City mayoral candidate Zohran Mamdani, a democratic socialist, plans to establish city-owned grocery stores to lower food prices, redirecting $140 million in private grocery store tax breaks to fund a $60 million pilot program for one store in each borough.

Criticism from Industry Leaders: Economists and business leaders, including Gristedes CEO John Catsimatidis, warn that the plan could disrupt the city’s food supply by outcompeting private grocers, who operate on slim 1-3% profit margins, potentially forcing closures or relocations.

Economic and Operational Concerns: Critics argue that city-run stores, exempt from rent and property taxes, could distort competition, exacerbate food shortages, and face challenges due to the city’s lack of supply chain infrastructure and operational expertise.

Walmart goes all out to stamp down beef prices with massive new processing facility

Walmart has launched its first owned and operated case-ready beef facility in Olathe, Kansas, a 300,000-square-foot plant designed to cut out middlemen and control soaring beef prices by sourcing Angus cuts directly from Sustainable Beef LLC for 600 Midwest stores, enhancing supply chain transparency and creating over 600 jobs to bolster local economic growth.

Nose to tail: The facility sources cattle directly from Sustainable Beef LLC, in which Walmart invested in 2022, creating an end-to-end supply chain to enhance transparency, traceability, and quality in the concentrated U.S. beef industry.

Efficiency improvements: By eliminating middlemen, Walmart expects to offer competitive pricing, improve fresh food perception, and attract higher-income shoppers, while the facility creates over 600 jobs and boosts local economic growth.