- The Capitalist

- Posts

- Trump says banks rejected him, are "debanking" conservatives

Trump says banks rejected him, are "debanking" conservatives

Trump's claims echo ongoing conservative allegations of "debanking," where banks are accused of unfairly denying services to conservative clients based on political beliefs...

Hello Capitalists,

Trump reignites the issue of “debanking” of conservatives after he reveals that it happened to him. Sydney Sweeny makes American Eagle soar again. Modular houses are coming to Wall Street and Dave Portnoy has some very strong words for GenZ “Democratic Socialists” and how they make him feel.

Here’s everything you need to be following today:

DOW: 44638.04 - (⬆️0.01) ✅

S&P: 6381.16 - (⬆️0.16) ✅

NASDAQ: 21178.49 - (⬆️0.38) ✅

CBOE VIX Volatility Index: $16.04 (⬆️0.06) ⚠️⬆️

Trump names two Wall Street banks for “De-banking” him for being a Republican

President Donald Trump claimed Tuesday that JPMorgan Chase and Bank of America rejected him as a customer, alleging political bias in their decisions, during a wide-ranging interview on CNBC's "Squawk Box" where he revived accusations of conservative "debanking" by major U.S. banks.

President Donald Trump stated on CNBC's "Squawk Box" that JPMorgan Chase gave him 20 days to move "hundreds of millions of dollars in cash" to another bank and that Bank of America refused to open an account for him to deposit over a billion dollars.

Trump's claims echo ongoing conservative allegations of "debanking," where banks are accused of unfairly denying services to conservative clients based on political beliefs.

JPMorgan Chase denied targeting conservatives or Trump supporters, stating they do not close accounts for political reasons and called for regulatory changes to address such issues.

The accusations come amid broader Republican criticisms of major banks, with Trump previously targeting the CEOs of both banks at the World Economic Forum in January 2025 for similar reasons.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

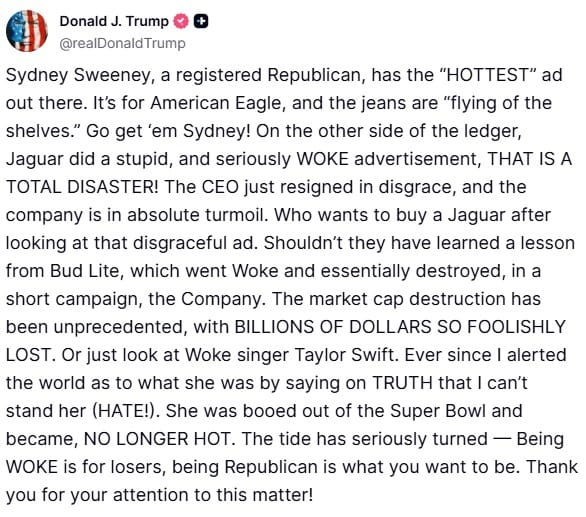

American Eagle stock surges off Sydney Sweeny’s mega-viral ad and Trump’s praise

American Eagle Outfitters Inc. shares surged Monday, reaching a two-month high, after President Donald Trump praised a controversial ad campaign featuring actress Sydney Sweeney, fueling a meme stock rally amid debates over the ad’s messaging.

American Eagle Outfitters' stock jumped nearly 24% on Monday, hitting a two-month high, following President Trump’s praise of Sydney Sweeney.

The ad, part of a campaign with the tagline “Sydney Sweeney Has Great Jeans,” sparked a woke backlash for its perceived eugenics references due to wordplay on “jeans” and “genes,” with critics alleging it promoted racial discrimination.

Trump’s endorsement, highlighting Sweeney’s reported Republican voter registration, boosted the stock’s meme-driven rally, marking its largest single-day percentage increase since August 3, 2000.

Quote of the Day:

“On the free market, it is a happy fact that the maximization of the wealth of one person or group redounds to the benefit of all; but in the political realm, the realm of the State, a maximization of income and wealth can only accrue parasitically to the State and its rulers at the expense of the rest of society.”

Modular house startup Boxabl will go public on Wall Street in billion dollar merger

Las Vegas-based modular housing startup Boxabl will go public through a $3.5 billion merger they announced Tuesday, aiming to expand production of its affordable, foldable homes to meet rising demand amid a national housing crisis.

Public Listing via SPAC: Boxabl, founded in 2017, will merge with FG Merger II in a $3.5 billion deal to list on Nasdaq under the ticker "BXBL," allowing it to bypass some traditional IPO scrutiny.

Affordable Housing Solution: The company designs and manufactures foldable, modular homes, including its 361-square-foot "Casita" model, priced as low as $19,999, to address housing affordability and scalability.

Expansion and Innovation: The merger will fund expanded production capabilities and research to meet growing demand, driven by record-high housing prices and a supply crunch.

Financial Strategy and Leadership: Led by co-CEOs Paolo and Galiano Tiramani, Boxabl has raised over $230 million, including through crowdfunding, and adopted a bitcoin treasury strategy in May.

Palantir blows Wall Street’s minds with $1B Quarterly revenue

Palantir Technologies surpassed Wall Street expectations with a record-breaking $1 billion in quarterly revenue for the first time.

Palantir reported $1 billion in quarterly revenue for the first time, exceeding Wall Street's $940 million estimate, with adjusted earnings of 16 cents per share against an expected 14 cents.

The company's revenue grew 48% year-over-year, driven by strong AI demand, particularly in U.S. government contracts, which increased 53% to $426 million, bolstered by President Trump’s efficiency campaign.

Palantir raised its full-year revenue forecast to $4.142 billion to $4.150 billion, up from $3.89 billion to $3.90 billion, while CEO Alex Karp highlighted plans to grow revenue while reducing headcount from 4,100 to an ideal 3,600.

The stock surged over 8% post-earnings, with a year-to-date increase of 112.4%, though analysts remain divided due to its high valuation at 277 times forward earnings.

Elon gets a bumper payday from Tesla in cash and shares

Tesla awarded CEO Elon Musk a $29 billion compensation package with 96 million shares on Monday, aiming to secure his leadership.

Tesla granted Musk the interim compensation package to retain him as the company pivots to robotaxis and humanoid robots.

The award replaces a $50 billion 2018 pay package struck down by a Delaware court, which is under appeal, with Musk having no active compensation plan since 2017.

The package requires Musk to remain a top executive for two years and is contingent on the 2018 plan not being reinstated, amid concerns about his focus due to political activities and other ventures like xAI and SpaceX.

Tesla’s board views the award as a “good faith” move to ensure Musk’s “extraordinary talent” remains with the company, which faces declining EV sales and a competitive landscape.

Dave Portnoy loses his cool over young Democrats who want socialism

Barstool Sports founder Dave Portnoy sparked controversy on his podcast by declaring that Generation Z Democrats' support for socialism makes him "want to puke," citing concerns over economic policies and government overreach.

He criticized the younger generation's economic views, suggesting they lack understanding of financial realities and are drawn to policies like those associated with Sen. Bernie Sanders.

Portnoy argued that socialism leads to excessive government control and economic stagnation, contrasting it with his preference for capitalist principles.

The remarks, made during a discussion with co-hosts Josh Richards and Brianna LaPaglia, have stirred debate online, with some praising his candor and others accusing him of oversimplifying complex economic issues.